Overview

Financing Fund for the Agriculture Sector

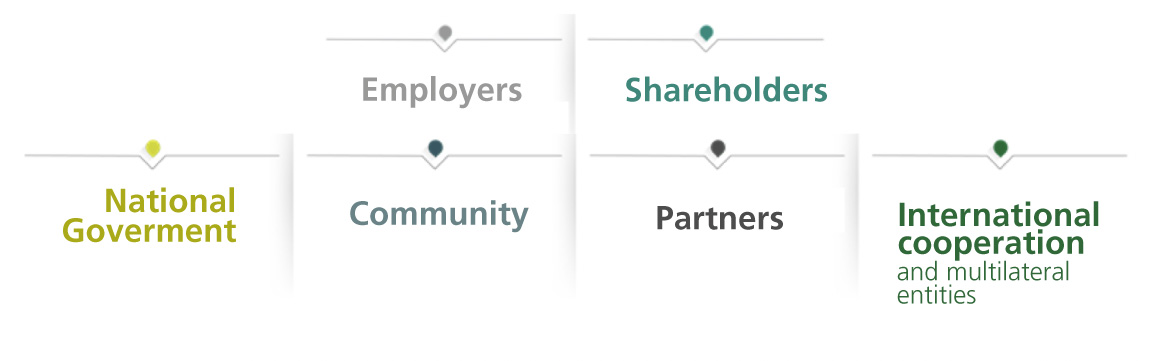

The Fund for the Financing of the Agricultural Sector (FINAGRO) is an entity that promotes the development of the Colombian rural sector, with financing and rural development instruments that stimulate investment.

It is a national mixed economy company, organized as a credit establishment, with a special regime, which is part of the Bicentenario Group, the Ministry of Finance and is supervised by the Financial Superintendency of Colombia.

FINAGRO acts as a second-tier entity, that is, it grants resources under promotional conditions to financial entities, so that they in turn grant credits to productive projects. Likewise, to facilitate access to financing, FINAGRO administers instruments for the development of your agricultural project.

Mission

We work for an inclusive, equitable and sustainable countryside, to generate a better quality of life and well-being for the Colombian rural population.

Vission

Consolidate ourselves as the financial entity for the development of the Colombian agricultural and rural sector.

1. Customers: financial intermediaries.

2. Beneficiaries: farmers, agriculture production trades, and farmers associations.

FINAGRO as a strategic stakeholder for the sustainable development of the agriculture and rural sector, by financial products and services, which contribute to the creation of economic value, social and environmental to build the competitiveness and sustainability of this sector, run their actions under the following policies:

- We communicate in a timely and wide way the policies with an easy and understandable language for our customers.

- We guarantee timely answers to the requests of our products and services according to the stablished regulations.

- With our human talent, we achieve the results under principles of transparency, efficiency and effectiveness.

- We carry out and joint in an efficiency way the direction of the public politics for the agricultural and rural sector.

- We act with rectitude and attachment to our principles and values.

Our system joints the management of our processes with a perspective based on risks, with the commitment to accomplish the regulations just like to improve the effectiveness and efficiency of SIG (Integrated management system) and of the products and services.

Corporate principles

Loyalty, transparency, honesty, due diligence, confidentiality, impartiality and obligatory nature.

- Organization Chart

| POSITION | NAME | EXT. | |

|---|---|---|---|

|

President |

Ángela María Penagos Concha |

ampenagos@finagro.com.co |

Ext. 100 |

|

General Secretary |

Felipe Clavijo Ospina |

fclavijo@finagro.com.co |

Ext. 165 |

|

Economic Research Manager |

Julián García Cardona |

jgarcia@finagro.com.co |

Ext. 410 |

|

Vice Chairman of Guarantees |

Jorge Eduardo Soto Mejía |

jsoto@finagro.com.co |

Ext. 298 |

|

Vice Chairman of Operations |

Andrés Lozano Karanauskas |

alozano@finagro.com.co |

Ext. 106 |

|

Vice Chairman of Investments |

Juan Pablo Bustamante |

jbustamante@finagro.com.co |

Ext. 260 |

|

Vice Chairman of Financial Officer |

Ricardo Ignacio Morris |

Ricardo Ignacio Morris |

Ext. 127 |

|

Vice Chairman Commercial |

Rodolfo Bacci Trespalacios |

rbacci@finagro.com.co |

Ext. 110 |

|

Chief of Control and Promotion Office |

Juan Mauricio León |

jleon@finagro.com.co |

Ext. 107 |

|

Chief of Risk Management |

Oscar Anzola |

oeanzola@finagro.com.co |

Ext. 124 |

| Director of Non-Traditional Banking and New Segments | Amparo Mondragón Beltrán | amondragon@finagro.com.co | Ext. 372 |

|

Chief of planning |

Juan Carlos Restrepo |

jrestrepo@finagro.com.co |

Ext. 192 |

| Sectorial Information and Agricultural Risk Management Directorate | María Mónica Rangel Cobos | mrangel@finagro.com.co | Ext. 291 |

|

Chief of management administrative. |

Luis Alfredo Pineda Pulgarín |

lapineda@finagro.com.co |

Ext. 169 |

|

Chief of Technology |

Gilberto Mauricio Giraldo Ramírez |

gmgiraldo@finagro.com.co |

Ext. 243 |

|

Chief of Legal |

William García Correa |

wgarcia@finagro.com.co |

Ext. 259 |

|

Chief of contracting |

Clara Eugenia Sarmiento Arzuaga |

csarmiento@finagro.com.co |

Ext. 380 |

|

Chief of Credit and Incentives |

Sedney Rolando Monroy |

smonroy@finagro.com.co |

Ext. 194 |

|

Chief of Back Office |

María Claudia Asmar |

masmar@finagro.com.co |

Ext. 233 |

|

Chief of Treasury |

Ricardo Morris Sarmiento |

rmorris@finagro.com.co |

Ext. 127 |

|

Chief of Accounting |

- |

- |

- |

|

Chief of Technological Operations |

Luis Francisco González |

lgonzalez@finagro.com.co |

Ext. 242 |

|

Chief of Administrative Services |

Jaime Villa |

jvilla@finagro.com.co |

Ext. 173 |

|

Chief of Guarantees |

José Pío Gracia Lobo |

jgracia@finagro.com.co |

Ext. 212 |

|

Chief of Loan Portfolio Standardization |

Carlos Andrés Camacho |

ccamacho@finagro.com.co |

Ext. 155 |

|

Chief of Customer Service |

Morelca Maria Giraldo |

mgiraldo@finagro.com.co |

Ext. 360 |

| Human Talent Director | Marisol Duque Gómez | mduque@finagro.com.co | Ext. 169 |

|

Forestry Director |

Carlos Mario Betancur |

cbetancur@finagro.com.co |

Ext. 333 |

|

Chief of not Traditional banking and new segments |

Amparo Mondragón |

amondragon@finagro.com.co |

Ext. 372 |

|

Chief of Management Recovery |

Angela Mercedes Carvajal |

acarvajal@finagro.com.co |

Ext. 450 |

|

Chief of registration of operations |

Néstor León Ceballos |

nleon@finagro.com.co |

Ext. 323 |

|

Chief of customer service. |

Juan Carlos Botero |

jbotero@finagro.com.co |

Ext. 264 |

|

Chief of Statistics |

Mauricio Berrío |

mberrio@finagro.com.co |

Ext. 204 |

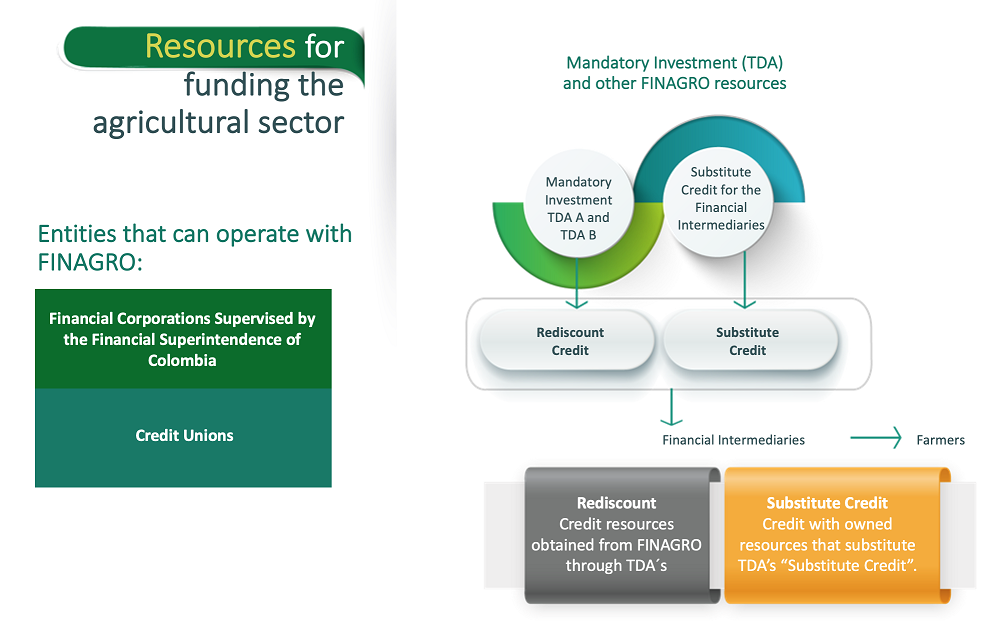

By these financial intermediaries you can get an agricultural credit.

- Title for Agricultural Development (TDA)

The TDA´s are the main funding resources of FINAGRO. Its definition is based on the Resolution 3 of 2000 of the Board of Directors of the Central Bank of Colombia and every 3 months the Financial Superintendence and FINAGRO determines the amount of the TDA´s resources. The maturity of these titles is to (1) year, with interest payments every 3 months.

The interest rates for the TDA´s is below of the interest rates offered in the financial market.

Currently, the TDA are indexed in Interbank Reference Rate (IBR).

DTF: Fixed Term Deposite

TDA´s type “A”: For small farmers TDA´s

type “B”: For medium and large farmers

What does FINAGRO do?

Through of financial entities, FINAGRO offers credit resources to promote the agricultural and livestock sector with low interests, and also applies incentives and guarantees.

Where can I apply for a credit?

Any entity of credit controlled by the Financial Superintendence of Colombia like: Banks, Financial Corporations, Commercial Financial Companies, and the Cooperatives controlled by Solidary Economy Superintendence and also that fulfill with the defined aspects by FINAGRO as financial cooperatives and bodies which operate as cooperatives. The producer does not do any contact or procedure before FINAGRO.

What kind of projects can I finance?

It is possible request resources in order to develop agricultural, livestock, fishing, aquatic, forest projects and rural activities as handicrafts, rural tourism, transformation of metals and precious gems and mining.

If I already got a credit, can I get another?

Yes, with the condition that you borrow-ing capacity allows it and that your productive project generates the resources in order to pay the new obligations.

Can I finance the development of a project in a rented land?

Yes, the projects can finance in a rented land, own land or where you prove the possession.

Where can I to find the Handbook of Products and Services?

The update handbook of products and services of FINAGRO is published at www.finagro.com.co

Who does decide to approve or reject a credit?

The Financial Intermediary through which was processed the credit. This entity is autonomous and responsible for the analysis and approval of the applications.

How much time does take the approval of a credit?

Depends on if the users fulfill the requirements, and the agility of the financial intermediary and after, FINAGRO can disburse in the next working day of the application.

Is the rate of interest fixed during the term of the credit?

No, the rate of interest is defined based on the last rate current effective annual DTF, at the beginning of the period of interests generation plus the additional points which cannot change.

What is the term to pay the credit?

Depends on the productive cycle of the project. If the activities that are going to finance are working capital, the maximum term is until 2 years. On the projects of investment, the term is agreed with the financial intermediary.

How can I agree the payment of the credit?

It is possible to agree the payment: monthly, bimonthly, quarterly, biannual, annual according to the cycle of the project and its cash flow.

Producers

What is the rate of interest that collects to me?

The rate of interest is independent of the activity that is going to finance and depends on the kind of producer. The maximum rate for small producer is until DTF+7 E.A and the rate of the others producers is until DTF+10 E.A.

What is the amounts that can you borrow me?

For the small producers there is a limit until $65.401.525 for 2015 and for the middle and big producers the maximum amount depends on the capacity of payment of the producer and the productive project to finance. The recommendation is requesting which you can pay.

Who is the small producer?

The nature person who has assets until $93.430.750 for 2015, including the assets of the spouse and must fulfill one of the following conditions:

Al least the 75% of their assets have to invest them on the agricultural and livestock sector.

The 2/3 of their incomes have to come from the agricultural and livestock activity.

Guarantees

What are the guarantees requested by FINAGRO?

FINAGRO does not require guarantees because does not lend in a direct way. The financial intermediary is who requires the guarantees to back the debt.

What kinds of guarantees are requested by the Financial Intermediaries?

They request the mortgage of one of your possessions, but if this is not enough to cover the amount to finance, you can go to the Agricultural and Livestock Fund-FAG managed by FINAGRO in order to give you the guarantees for the amount not manage to cover your possession.

Is necessary to go to FINAGRO to request the guarantee of FAG?

Not, because the application of the guarantee before FINAGRO is processed by the Financial Intermediary.

Please contact us:

FINAGRO Offices: Carrera 13 No. 28-17 Floors 2, 3, 4 and 5.

PBX: +57 1 3203377 Fax: +57 1 3380197 A.A. 241951 Bogotá, D.C.

Contact center +57 1 5953522 - The rest of the country, Agro-line 01 8000 912219

Schedule of attention to the public: Monday to Friday from 8:00 a.m. to 5:00 p.m.

E-mail: finagro@finagro.com.co

Suggestions, complaints, or claims

This section has been designed for FINAGRO’s customers to express their complaints, claims, suggestions and request of information regarding with the service of our Entity.

SAC - Financial Customer Service

The Regime for the protection to the financial consumers is compiled by The Law 1328, 2009 in three aspects: a) Provision of the information b) Attention and Protection of the Financial Consumer and c) Legal counsel for the Financial Consumer, and also considers the obligation of the controlled entities by the Financial Superintendence of Colombia of implementing a “Financial Customer Service- SAC”, in order to consolidate an environment of attention, protection and respect to the financial consumers.

For this reason, from 2010, FINAGRO implemented the Handbook SAC which are stablished the policies, procedures and programs in order to guarantee an effective and suitable operating itself and also focused on:

Provide right information.

Strengthen the procedures for the attention to the complaints, claims and suggestions.

Promote the protection to the rights of the financial consumers and their financial education.

FINAGRO through the web: www.finagro.com.co gives the channels to you can register your complaint, request information, give suggestions or congratulations related with our mission, for this we have the following channels:

- Suggestions, Requests, Complaints or claims

- Answers to Frequent questions

- Chat

- Personalize attention and guidance

- Analysis contact center January 2015

Financial Education

FINAGRO through of Financial Customer Service (SAC) and like a member of ASOBANCARIA, have consolidated a series of programs and campaigns of education that allow to the consumers in a simple way to understand the characteristics of the different products and services offered by FINAGRO, and the compilation of the interested subjects about Financial Education.

As a result, we invite you to click the link of the web ASOBANCARIA “Saber Más Ser Más”, name given to the Financial Education Program for the Colombian Bank in order to make aware to the population about the importance of learning in financial subjects, giving tools in order to improve the knowledge and the habits for managing their personal and family finances and therefore to do contact with the financial system. Additionally, you will find Financial Schedules, advices for saving, information to the financial consumer, suggestions of security, financial calculators and other interesting subjects.

Chat on line

Welcome to our chat on line

In this section you can find the information that are you looking for the products and services offered by FINAGRO.

Our specialized advisors will attend you at real time from 8:00 am to 5:00 pm; off the lock, you can let us theirs concerns and these will be answered the next working day.

Rights of Requests

In compliance of the Law 1474, 2011, FINAGRO publish the relationship of Rights of Requests filed during 2014 with the respective information about the procedure; this information will be update regularly. The defined terms according to the regulations are 15 working days to reply these applications.

Simulator of the credit

Welcome to the Simulator of Credit of FINAGRO, this tool helps you to know all the financial opportunities offered by FINAGRO. This simulator is an aid for the users; however it is important to take into account that is an approximation. If you want to get more information, please contact to the Contact Center or to our Customer Service Office in Bogotá- Colombia 571-3203377 Ext. 141-274-119-154

Types of Communication

Complaints or claims: These are which facts happened by a possible un-fulfillment of the rules which regulate the development or realization of services or product offered, regarding with the quality of themselves.

Suggestions: These are the advices in order to improve, facilitate, clarify or regularize the relationships with the customers and the correct provision of services.

Request of information: These are the requests received through of the indicate ways in the procedure, which require general or specific information about the products or services of the Entity.

Congratulations: These are the recognitions about the provided service, expressed by a user.

Accountability

Public audience of accountability Management FINAGRO 2014

The Financing Fund for the Agricultural and Livestock Sector-FINAGRO did a public audience of accountability of its management in 2014, the 12th May, 2015 as a strategy of Senior Management in order to fulfill with the duty to inform and to reply publicly to the all interested parts and the citizenship in general, for the management of the assigned resources by the National Government inside of the public policy to the financial support of the producers in the implementation and development of theirs productive projects and for the decisions and management made in 2014.

Next, you will find the respective information about the Public Audience of Accountability Management 2014, any questions please write to e-mail: mhernandez@finagro.com.co

Circumstances Analysis

With the purpose to get the most important update information about the performance of the economy and the financial sector as national as international, FINAGRO publishes the Financial Economic Observer.

Annual Report

In this section you will find the Annual Report from 2006:

- Management Reports

- Sustainability Reports

- Activities Reports

Anticorruption and attention to the citizen plan

According to the Decree 2641 of 17th, December 2012, FINAGRO has an anticorruption and attention to the citizen plan, in this are compiled the control diagrams, policies, strategies and others aspects in order to avoid the risks related on the corruption.

All information about the control of risks inside FINAGRO like its causes, matrixes, controls are considered confidential, but these can be consulted through a request introduced to the Secretary’s General Office and they decide if this request is pertinent or not.

Media

These are the media through which you can report any irregular behavior or any act against the ethics related on corruptions event or fraud.

Today are available the free phone line 2880431 and the e-mail lineaetica@finagro.com.co. The information is absolutely reserved and anonymous in order to report the previous information.

Characteristics

The phone line is available from Monday to Friday from 8:00 am to 5:00 pm.

The e-mail is available 24 hours

Your complaints are confidential and if you want anonymous.

Calls are attended by a person who will do a collection process of complete and pertinent information.

Kinds of complaints

Foul to the Ethics Code

Fraud

Defalcation of resources

Bribes, gifts with appearance of corruption

Who can file the complaints?

Employees

Administrators

Customers

Suppliers

Users and general public